Do You Get A 1099 For Mileage Reimbursement . the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. That means employees will receive a certain amount of compensation for every mile they drive for the business. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the.

from printableformsfree.com

to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. That means employees will receive a certain amount of compensation for every mile they drive for the business.

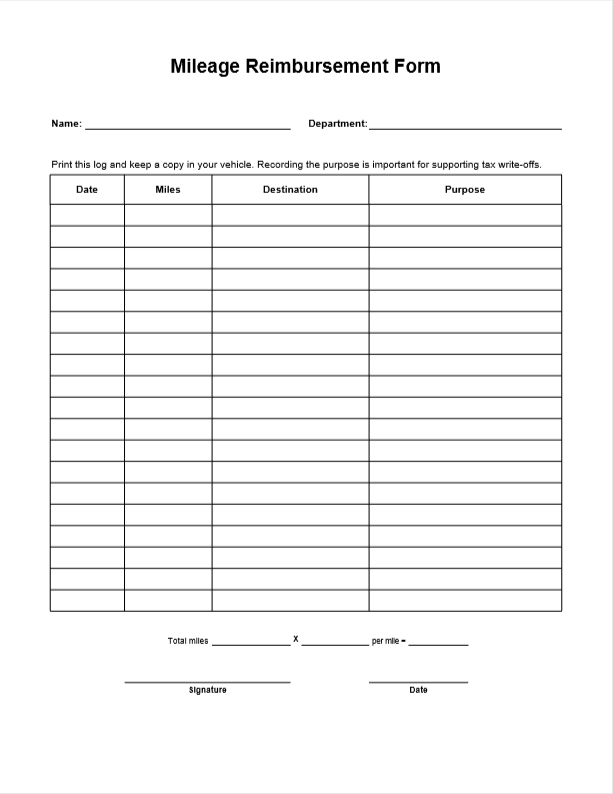

Printable Mileage Reimbursement Form Printable Forms Free Online

Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. That means employees will receive a certain amount of compensation for every mile they drive for the business. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for.

From cejjqemv.blob.core.windows.net

How To Ask For Mileage Reimbursement at Mildred Underwood blog Do You Get A 1099 For Mileage Reimbursement for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any. Do You Get A 1099 For Mileage Reimbursement.

From www.pinterest.com

This mileage reimbursement form can be used to calculate your mileage Do You Get A 1099 For Mileage Reimbursement the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it. Do You Get A 1099 For Mileage Reimbursement.

From cebhrkkd.blob.core.windows.net

Do You Issue A 1099 For Reimbursements at Edward Flynn blog Do You Get A 1099 For Mileage Reimbursement for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. That means employees will receive a certain amount. Do You Get A 1099 For Mileage Reimbursement.

From form-1099r.com

how do i get a copy of my 1099 from the irs Fill Online, Printable Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. the internal revenue service sets a standard. Do You Get A 1099 For Mileage Reimbursement.

From sample-excel.blogspot.com

24+ Vehicle Lease Mileage Tracker Sample Excel Templates Do You Get A 1099 For Mileage Reimbursement the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. That means employees will receive a certain amount of compensation for every mile they drive for the business. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit. Do You Get A 1099 For Mileage Reimbursement.

From printableformsfree.com

Printable Mileage Reimbursement Form Printable Forms Free Online Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. . Do You Get A 1099 For Mileage Reimbursement.

From managementlasopa470.weebly.com

1099 receipt tracker free managementlasopa Do You Get A 1099 For Mileage Reimbursement the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return. Do You Get A 1099 For Mileage Reimbursement.

From patch.com

A New Way to Get Your Replacement SSA1099 Online Wakefield, MA Patch Do You Get A 1099 For Mileage Reimbursement That means employees will receive a certain amount of compensation for every mile they drive for the business. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. the internal revenue service sets a standard. Do You Get A 1099 For Mileage Reimbursement.

From sandeyjocelyn.pages.dev

2024 Mileage Reimbursement Rate Chart Pdf Download Nicky Lianna Do You Get A 1099 For Mileage Reimbursement Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. Mileage can be deducted for volunteer work. Do You Get A 1099 For Mileage Reimbursement.

From www.peakadvisers.com

Action required for tax form 1099 filers Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. for 1099 mileage deductions and meal deductions, one must determine which mileage deduction method they qualify for. That means employees will receive a certain amount of compensation for every mile they drive for the business. Contrarily, if the reimbursement exceeds. Do You Get A 1099 For Mileage Reimbursement.

From www.sampleforms.com

FREE 9+ Sample Mileage Reimbursement Forms in PDF Word Excel Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. for 1099 mileage deductions and meal deductions, one must determine which mileage. Do You Get A 1099 For Mileage Reimbursement.

From performflow.com

9+ Free Mileage Reimbursement Forms To Download PerformFlow Do You Get A 1099 For Mileage Reimbursement That means employees will receive a certain amount of compensation for every mile they drive for the business. to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by. Do You Get A 1099 For Mileage Reimbursement.

From zoeysabina.pages.dev

2024 Mileage Reimbursement Rate Form Download Elsi Nonnah Do You Get A 1099 For Mileage Reimbursement That means employees will receive a certain amount of compensation for every mile they drive for the business. the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. to have the reimbursement not hit their tax reporting first, they must have. Do You Get A 1099 For Mileage Reimbursement.

From tipalti.com

Tax Form 1099MISC Instructions How to Fill It Out Tipalti Do You Get A 1099 For Mileage Reimbursement the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it. Do You Get A 1099 For Mileage Reimbursement.

From projectopenletter.com

Example Mileage Reimbursement Form Printable Form, Templates and Letter Do You Get A 1099 For Mileage Reimbursement the internal revenue service sets a standard mileage rate every year which for 2023 stands at 65.5 cents per mile for business use of a personal vehicle. That means employees will receive a certain amount of compensation for every mile they drive for the business. to have the reimbursement not hit their tax reporting first, they must have. Do You Get A 1099 For Mileage Reimbursement.

From www.tffn.net

Do You Include Travel Reimbursement in 1099? Exploring the Tax Do You Get A 1099 For Mileage Reimbursement to have the reimbursement not hit their tax reporting first, they must have provided substantial documentation, and the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. the internal revenue service sets a standard mileage rate every year which for 2023 stands. Do You Get A 1099 For Mileage Reimbursement.

From www.template.net

Mileage Reimbursement Form 10+ Free Sample, Example, Format Do You Get A 1099 For Mileage Reimbursement Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. That means employees will receive a certain amount of compensation for every mile they drive for the business. the. Do You Get A 1099 For Mileage Reimbursement.

From lonniyvalentine.pages.dev

Mileage Reimbursement 2024 Form Pdf Downloadable Shae Yasmin Do You Get A 1099 For Mileage Reimbursement Contrarily, if the reimbursement exceeds this rate and the employee fails to return any surplus amount, it is classified as taxable income by irs regulations. Mileage can be deducted for volunteer work and medical care, but irs restrictions limit the. That means employees will receive a certain amount of compensation for every mile they drive for the business. for. Do You Get A 1099 For Mileage Reimbursement.